Governance

Role of the Board of Directors

In 2025, MCNEX established an ESG Committee under its Board of Directors to serve as the decision-making body for managing and overseeing environmental management activities, including those related to climate change. The ESG Committee, composed of one internal director and three outside directors, deliberates on climate change-related agenda items and reviews the implementation status and performance of related activities. The ESG Management Team supports the smooth operation of the ESG Committee. The ESG Management Team identifies climate change-related issues and implements response measures in cooperation with relevant departments.

ESG Committee

No. | Date | Agenda | Resolution |

1st | March 14, 2025 | Appointment of ESG Committee Chairperson | Approved |

2nd | March 28, 2025 | Report on 2024 ESG Evaluation Results | Reported |

Report on Materiality Assessment Results and Climate Change Risk Analysis Results | Reported | ||

Approval of 2025 ESG Strategic Direction and Publication of the 2024 Sustainability Management Report | Approved |

Role of Management

MCNEX systematically manages the climate change crisis by clearly defining the roles and responsibilities of its management in environmental management, which encompasses areas such as climate change response and biodiversity. The company's CEO holds overall responsibility for the environmental management system, including aspects related to climate change, and receives reports on key environmental issues like climate change through an annual Environmental and Safety meeting.

The company's CFO (Chief Financial Officer), who also serves as the Head of the Management Support Division, oversees ESG activities and the relevant implementation organizations concerning climate change response, safety and health, and human rights & labor. This role includes establishing environmental management-related plans and monitoring the progress of goal implementation.

Environmental and Safety Meeting

Category | Details |

Composition | Key executives centered around the CEO and heads of relevant departments |

Purpose | Review of key issues related to environment, safety, and health, and establishment of management plans |

Meeting | Annual regular meeting / Ad hoc meetings held as needed when significant environmental or safety issues arise |

Strategy

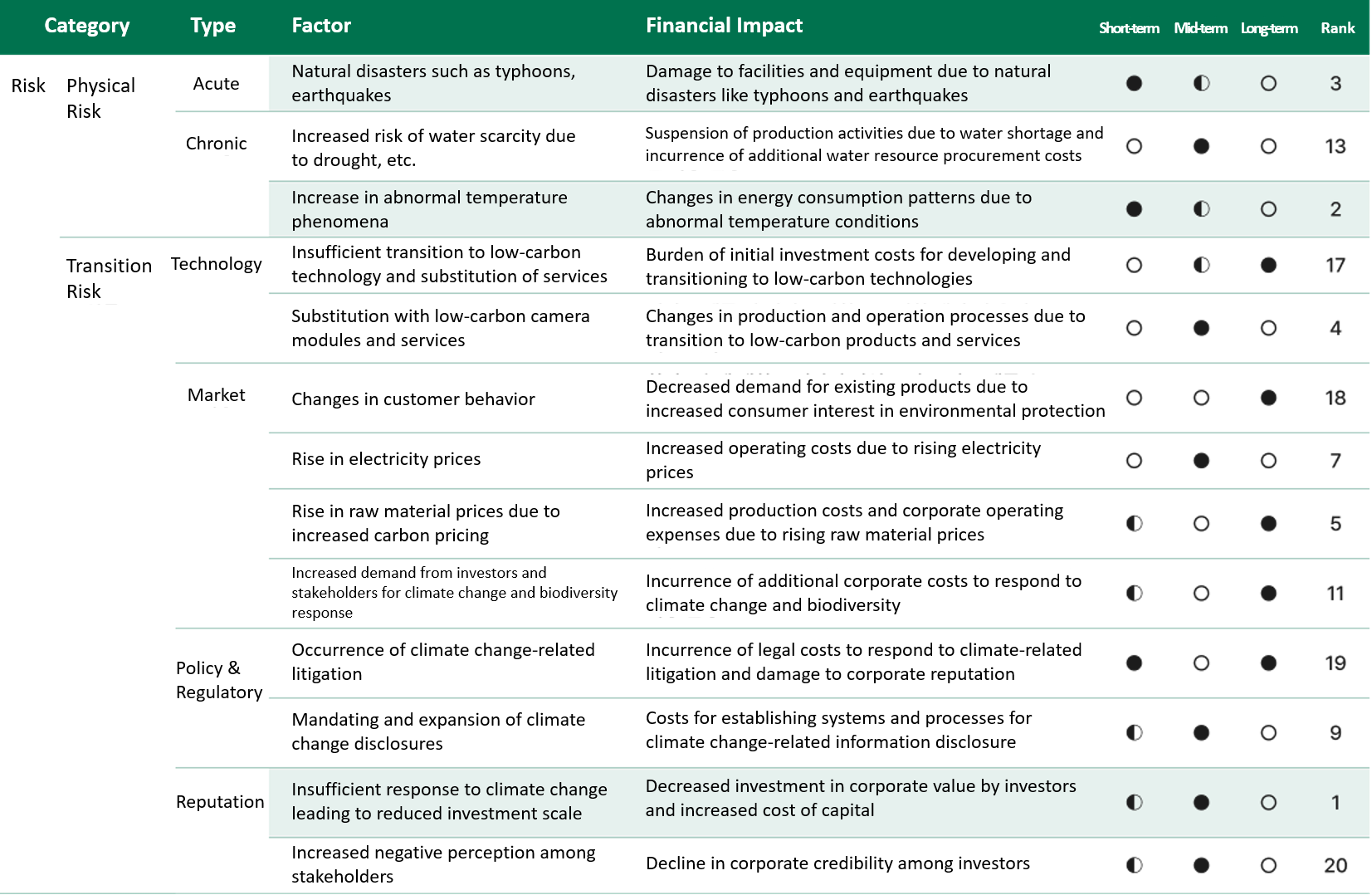

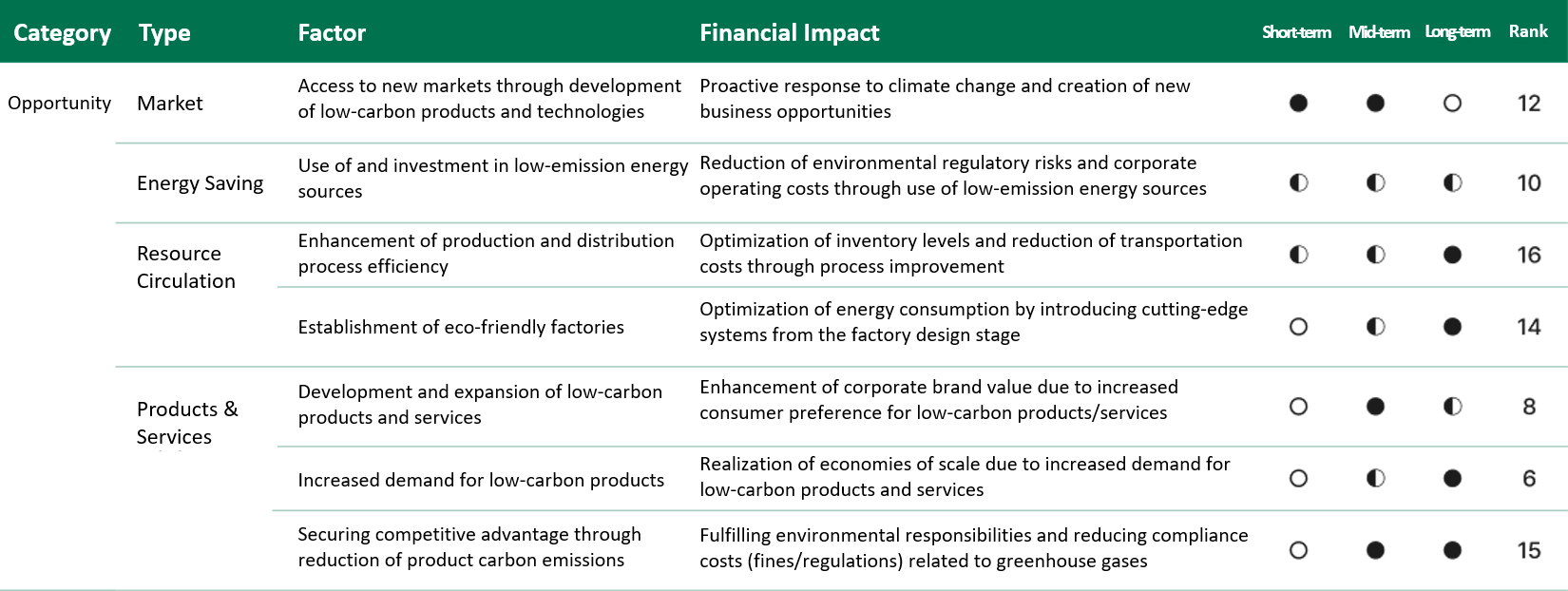

Climate Risks and Opportunities

Physical Risk

Natural disasters such as typhoons, earthquakes

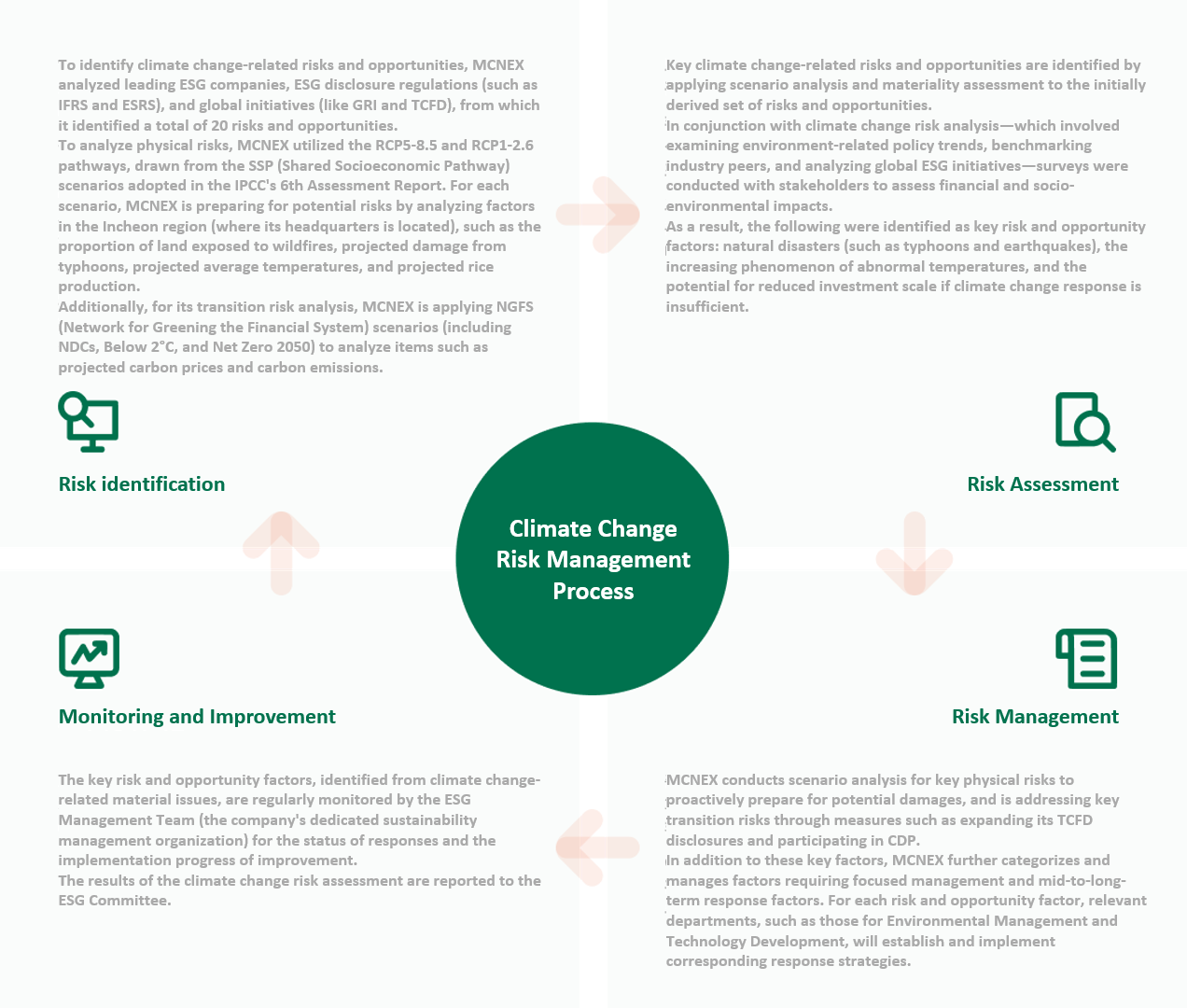

MCNEX identifies climate change-related physical risks for the Incheon region, where its headquarters is located, and is proactively responding to their major impacts. The climate change risk analysis applied the RCP 2.6 and RCP 8.5 scenarios. The RCP 2.6 scenario represents a case where atmospheric greenhouse gas concentrations are limited through global reduction efforts, while the RCP 8.5 scenario signifies a case where no such efforts are made.

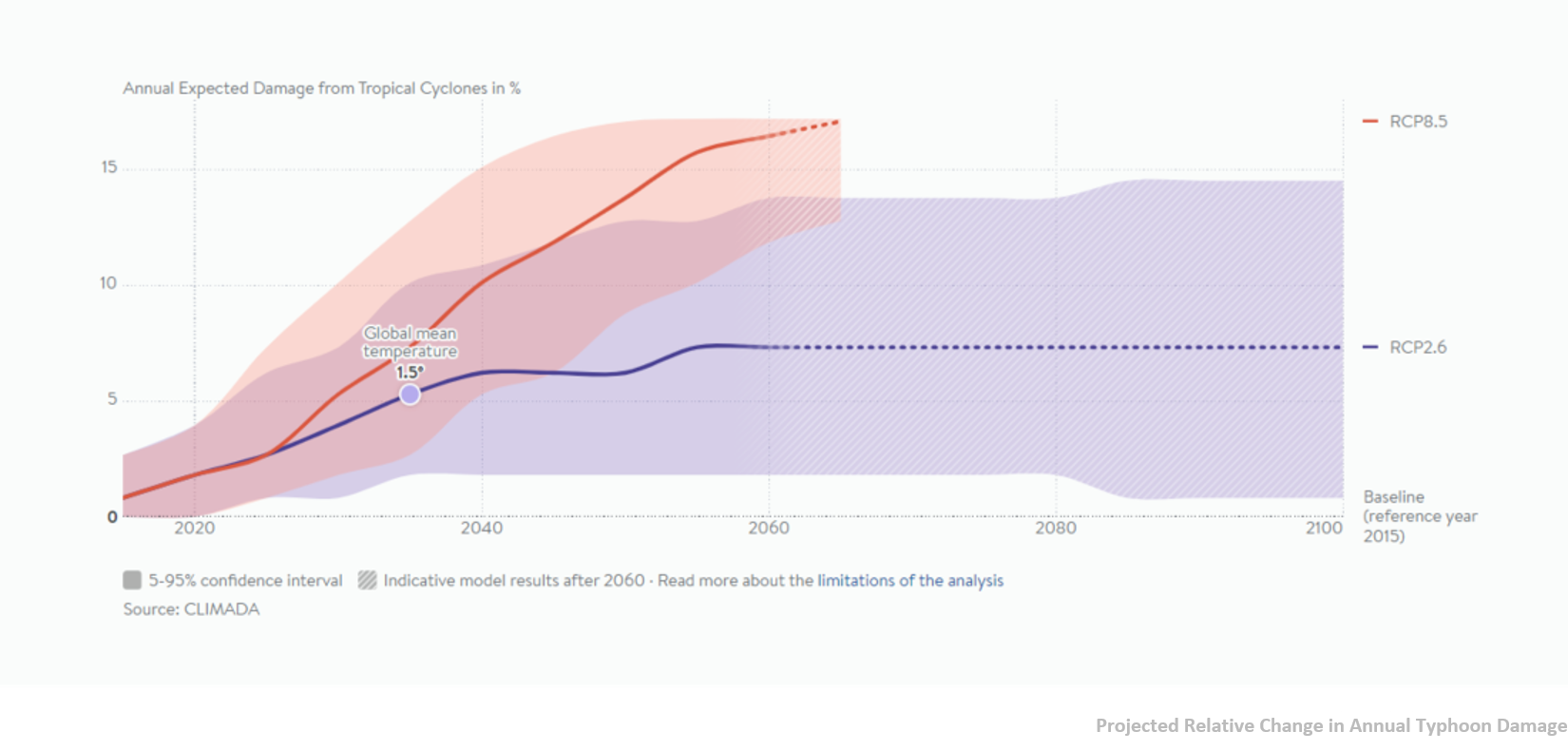

According to the physical risk analysis for natural disasters under the RCP 8.5 scenario, the projected annual increase in damage to tangible assets and inventory assets, resulting from direct typhoon damage to facilities and supply chain disruptions, is expected to reach approximately 10% by 2060 and increase to 15% by 2100.

Increase in abnormal temperature phenomena

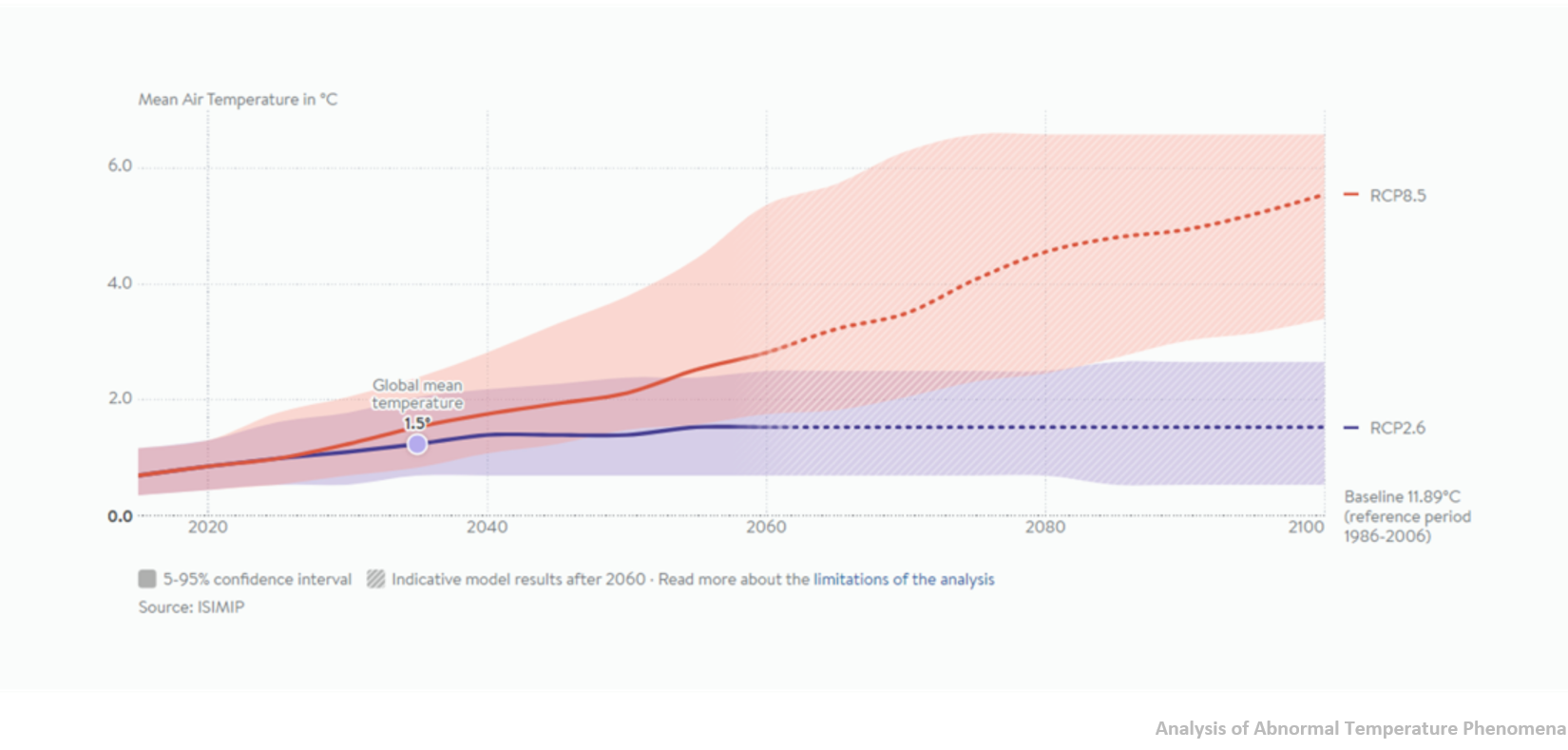

Recognizing the significance of increasing abnormal temperature phenomena, MCNEX is proactively responding through scenario analysis. A physical risk analysis was conducted applying the RCP 8.5 scenario, and the analysis results indicated that the average temperature in the Incheon region is projected to rise by more than 6°C by 2100. Operating costs are expected to increase due to factors such as the increased use of air conditioners resulting from rising temperatures. Accordingly, MCNEX is responding to climate change by installing solar panels.

Transition Risk

Insufficient response to climate change leading to reduced investment scale

Recognizing the severity of the global climate crisis, MCNEX is expanding its climate-related information disclosures for a sustainable future. MCNEX first disclosed climate change-related risk factors in its 2023 ESG Report. In its recent 2024 ESG Web Report, the company further expanded its climate-related disclosures, striving to align with TCFD reporting standards. In 2024, MCNEX participated in the global CDP (Carbon Disclosure Project), achieving a ‘Disclosure’ Level and thereby publicly sharing its climate change response status with stakeholders.

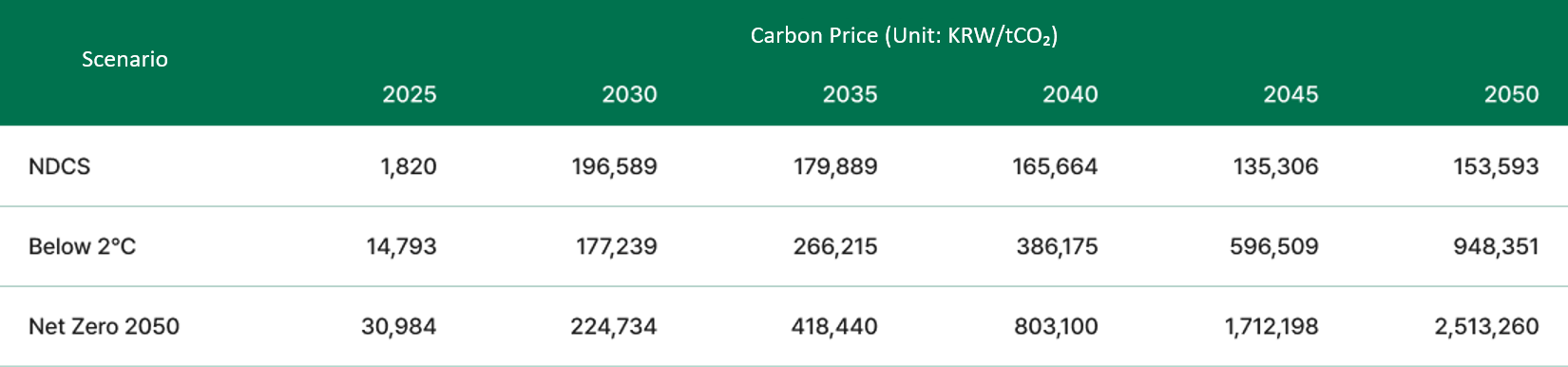

Additionally, MCNEX analyzed projected carbon costs by applying NGFS (Network for Greening the Financial System) scenarios, including NDCs, Below 2°C, and Net Zero 2050. It was confirmed that by 2050, when greenhouse gas reduction targets are due, the price of greenhouse gas emission allowances is expected to range from KRW 150,000 to a maximum of KRW 2,500,000. Accordingly, the carbon burden cost under the NDCs scenario is projected to be approximately 170 Mil. KRW.

Climate Change Risk Management

Goals and Indicators

Greenhouse Gas Reduction Plan

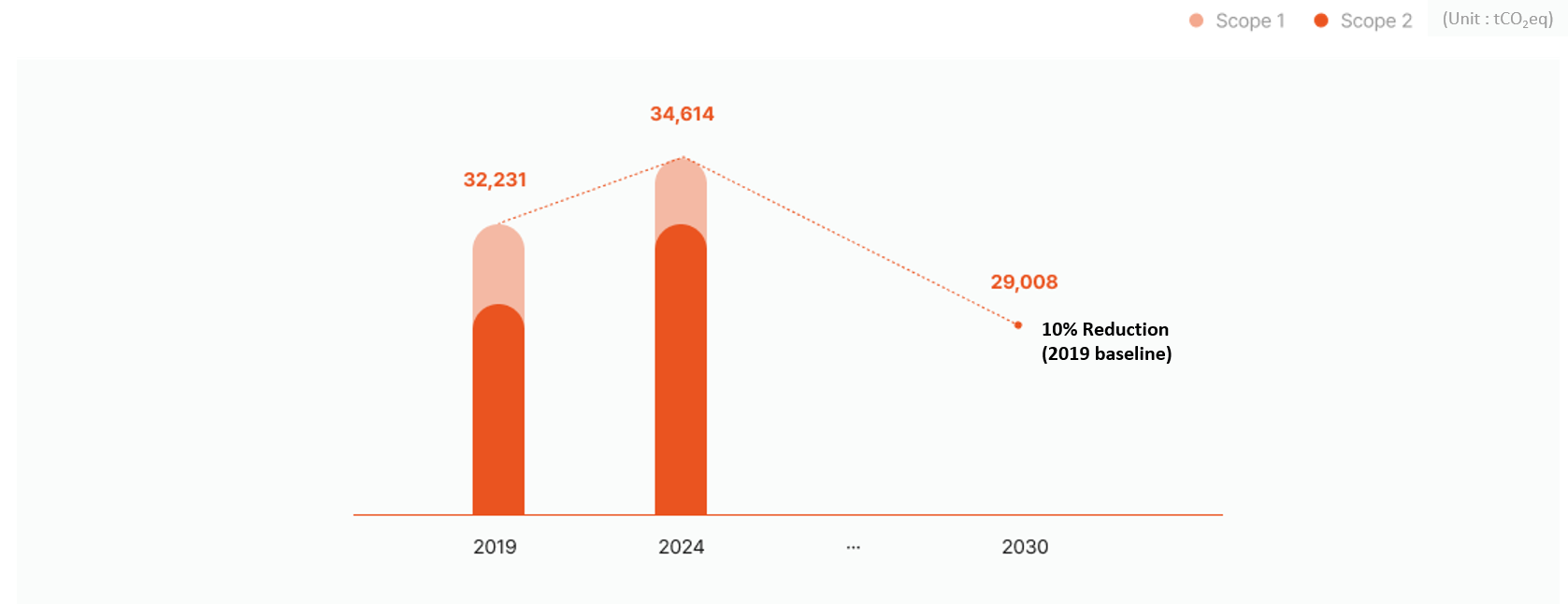

MCNEX keenly recognizes the severity of climate change and the significant impact related issues can have on the company. Accordingly, MCNEX has established a greenhouse gas reduction plan based on a scenario to limit the global temperature increase to 1.5°C compared to pre-industrial levels. To this end, the company is promoting greenhouse gas reduction activities, including managing GHG emission targets and performance, transitioning to eco-friendly energy, optimizing production processes, and enhancing energy efficiency. While advancing its greenhouse gas reduction plan, the company has set a reduction target of 10% by 2030 compared to 2019 levels. Subsequently, MCNEX plans to monitor its reduction performance and extend the plan through 2050.

Greenhouse Gas Reduction Plan